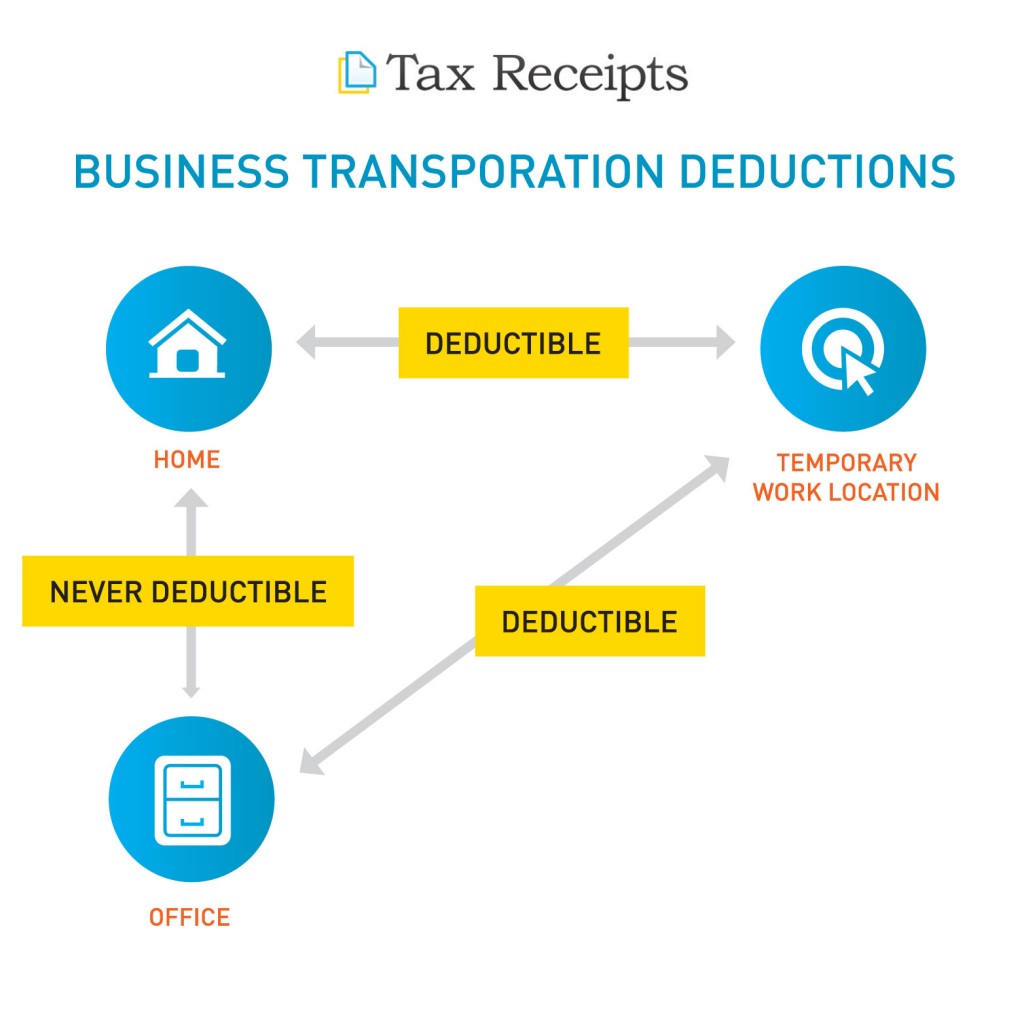

Small Business Transportation Deductions

The IRS does not allow deductions for commuting costs – going from home to work and back. But, you can deduct costs for transportation from one workplace to another. So, if you need to meet a client at his or her office or at a coffee shop, or other location, you can deduct the costs of traveling there from your office – whether it is a home office or a space you lease.