Advertising & promotion

Overview

Advertising activities include most of the things you do to get the word out about your business or draw attention to a product or sale.

Criteria

- Ordinary and necessary: An expense is ordinary if it's common to your profession. A necessary expense is one that's appropriate or helpful in developing or maintaining your business.

- Current expense: will benefit your business for less than one year

- Directly related to your business: not personal

- Reasonable in amount: reasonableness is dependent on the circumstances and not limited to a specific dollar amount

What is deductible

- Business cards

- Mailing lists / mailing list software

- Brochures

- Branded giveaway items

- Posters

- Web site design, development and maintenance

- Goodwill advertising: brand building that fosters a positive image for your business

- Ex: sponsoring a little-league team

- Case: The tax court allowed a gas station owner to deduct the cost of providing free beer to customers as a good-will advertising expense since it improved business.

What to collect

- Name of vendor

- Date

- Amount of expense

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- Personal expenses, even if they might help your business are not deductible. For example, expenses related to inviting customers to your daughter's wedding are not deductible.

- Advertising to influence government legislation is not deductible

- Do not deduct time and labor

Tip: Make sure you can show a clear connection between the advertising activity and your business.

Top of page

Bad debts

Overview

You can write off the costs of bad debts, but only if you've had an actual economic loss.

Criteria

- Bona fide business debt: A legal obligation to pay in the course of doing business

- The debt must be worthless: A debt becomes worthless when there is no longer any chance that you will be paid back

- Economic loss:

- Already reported income for the the amount you were supposed to be paid;

- You made a cash loan; or

- You made credit sales of inventory that were not paid for

What is deductible

- Debts from loaning money for a business purpose

- Debts from selling inventory on credit, or

- Debts from guaranteeing business loans

What to collect

- Documents to support the payment obligation - written notes, guarantees, etc

- Documents to show the debt is worthless - copies of unpaid invoices, collection letters, bankruptcy notices, etc

- Enter all of this information into your Expense Tracking System

Gotchas

- Investments do not count as business debts.

- Ex: Bill gives his brother Sam $25,000 in return for a 25% equity stake in Sam's company. This is an investment, not a business debt.

- If you sell services, you generally can't claim a bad debt deduction for the time you spent on the project if a customer fails to pay you.

Tip: Even though you can't write off the value of your time, you can deduct the cost of other expenses incurred in connection with a bad debt. For example, if a service client doesn't pay, you can deduct the cost of any supplies but not the value of your time invested.

Top of page

Bank fees & loan interest

Overview

You may deduct the interest and fees associated with any business bank accounts, credit cards or loans

Criteria

- Ordinary and necessary: An expense is ordinary if it's common to your profession. A necessary expense is one that's appropriate or helpful in developing or maintaining your business.

- Current expense: will benefit your business for less than one year

- Directly related to your business: not personal

- Reasonable in amount: reasonableness is dependent on the circumstances and not limited to a specific dollar amount

What is deductible

- Bank account fees

- Check printing fees

- Credit card processing fees

- Interest on mortgages, lines of credit or credit cards

- Loan origination fees

What to collect

- Name of vendor

- Date

- Amount of expense

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- No interest deduction is available for loans where you keep the money in the bank. Money kept in the bank is considered an investment.

- If you take out a business loan from a relative or friend, make sure to carefully document the transaction carefully and keep records to prove you actually paid the interest. The IRS closely examines loans between friends and relatives.

Tip: Establish a separate business bank account and credit card to avoid the hassle of trying to separate business and personal interest charges and fees.

Top of page

Casualty losses

Overview

Casualty losses include damage to property caused by a sudden, unexpected or unusual event.

Criteria

- Damage to business property by earthquake, storm, floods, or some other sudden, unexpected or unusual event

- Deduction is limited to amount not covered by insurance

- Case: The Tax Court disallowed a casualty loss deduction for an engine that was destroyed from a failure to use antifreeze. The Court stated that the taxpayer's neglect, and not freezing, was the cause of the damage.

What is deductible

- The adjusted basis of the property minus any insurance proceeds. Adjusted basis is the property's original cost minus any prior tax depreciation.

What to collect

- Receipt from original purchase of property

- Value immediately before and after the casualty

- Insurance claim, if any

- Adjusted basis of the property

- Documentation of loss: police report, etc

- Enter all of this information into your Expense Tracking System

Gotchas

- If you simply lose something, you can't take a casualty deduction.

- Losses as a result of damage by a pet are not deductible. So, if Fido eats your computer, you are out of luck.

- If the property is only partially destroyed, the casualty loss deduction is the lesser of the decrease in the property's value or its adjusted basis minus any insurance proceeds received.

Tip: If a piece of property or equipment has been fully depreciated or expensed, don't take a casualty deduction.

Top of page

Charitable contributions

Contributions by a

C corporation to a

qualified charity may be deductible as business expenses, but a tax professional should be consulted to calculate the amount of the deduction and the documentation required to substantiate the deduction.

Qualified charities are those organizations that have been approved by the IRS as tax exempt. To determine if a charity is qualified, you can search for the organization on the IRS website

here.

Contributions are not business expenses for owners of a sole proprietorship, partnership, LLC or S corporation. Instead, the contributions are personal deductions.

Top of page

Clothing

Overview

The clothing deduction is very narrow and only includes items that would be considered uniforms or protective clothing.

Criteria

- It is essential for your business;

- It is not suitable for ordinary street wear; and

- You don't wear the clothing outside of business.

What is deductible

- Cost of uniforms or special work clothes not suitable for personal wear

- Cost of dry cleaning and other care

What to collect

- Name of vendor

- Date

- Amount

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- If you can wear it on the street as part of an everyday outfit, the cost is not deductible. Unfortunately, the IRS thinks you can wear almost anything around town.

- Case: A musician in Rod Stewart's band was denied a deduction for most of his stage wardrobe, including silk boxers, leather pants, hats and vests, but was allowed a deduction for several items that the court felt were too gaudy for ordinary wear.

Tip: The costs of cleaning your clothing while on a business trip is an exception. You may deduct the cost of cleaning all of your clothing while on a business trip and you may deduct your first laundry bill for clothing used on your business trip when you return.

Top of page

Communication

Overview

As a business owner, you absolutely need methods of communicating with customers, vendors and colleagues. But, the IRS closely reviews these deductions, so make sure you are only deducting the portion used for business.

Criteria

- Ordinary and necessary: An expense is ordinary if it's common to your profession. A necessary expense is one that's appropriate or helpful in developing or maintaining your business.

- Current expense: will benefit your business for less than one year

- Directly related to your business: not personal

- Reasonable in amount: reasonableness is dependent on the circumstances and not limited to a specific dollar amount

What is deductible

- Internet access fees

- Phone expenses

- Cell phone expenses (see gotchas)

What to collect

- Name of vendor

- Date

- Amount of expense

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- Allocation of use may be necessary for cell phone and internet expenses that may be used for both personal and business purposes.

- Don't write off 100% of your cell or ISP charges if you use them for both business and personal purposes.

Tip: Save 3 months of your cell phone records and use them to establish the percentage of business vs personal use.

Top of page

Education

Overview

Business education deductions may be taken for seminars, professional development courses and a variety of other learning opportunities.

Criteria

- Required by law to keep your present job or income; or

- Required by your employer; or

- Maintains or improves skills needed in your present work.

What is deductible

- Tuition, books, supplies, lab and research fees, etc

- Transportation expenses (local education)

- Example: local university, college, or technical school that you commute to on a regular basis

- Deduct round-trip costs of transportation for education lasting one year or less

- Deduct one-way costs of transportation for education lasting more than one year

-

Travel expenses (overnight)

- Ex: seminar or conference to which you travel overnight

- Treated the same as standard travel expenses

What to collect:

- Transcripts, seminar agendas, brochures, speaker lists

- Name of vendor

- Date

- Amount

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- Education to qualify for a new trade or business is not deductible.

- Travel to "soak up the culture" may be educational but is not deductible.

- If a trip is primarily a vacation, only the cost of the course is deductible - not the airfare, lodging, etc.

- Expenses for seminars and courses on cruise ships or outside North America are limited by other rules.

Tip: Since education to qualify for a new business or profession is not deductible, try to limit educational costs in your new field until you've actually launched the business.

Top of page

Equipment

Overview

Any equipment with a useful life in your business for more than one year will be considered a capital (long-term) asset. Capital asset costs are treated under a different set of rules than current expenses, so make sure to consult your tax professional before taking an equipment deduction.

Criteria

- Ordinary and necessary: An expense is ordinary if it's common to your profession. A necessary expense is one that's appropriate or helpful in developing or maintaining your business

- Current expense: will benefit your business for less than one year

- Directly related to your business: not personal

- Reasonable in amount: reasonableness is dependent on the circumstances and not limited to a specific dollar amount

What is deductible

- Capital expenses can be depreciated over the equipment's useful life (as determined by the IRS), or

- You may be able to deduct half or all of the cost in one year using bonus depreciation or the Section 179 deduction of the Internal Revenue Code.

What to collect

- Name of vendor

- Date

- Amount of expense

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- If you want to deduct the cost of the asset in a single year, you must elect to expense it under Section 179. But, this is only available if your business is not in a tax loss position at the end of the year.

Tip: Section 179 enables you to deduct up to $250k of the cost of business equipment, so take advantage of it, if you can, and avoid the headaches and cost involved with calculating depreciation.

Top of page

Gifts

Overview

Gifts given to business contacts are deductible but are limited to $25 per person, per year.

Criteria

- Directly related to your business

- Deduction limited to $25 per person, per year

What is deductible

- Gifts with a value of up to $25 to any one person per year

What to collect

- Name of vendor from whom the gift was purchased

- Date

- Value of gift

- Recipient of the gift

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- Gifts to the spouse or child of a customer are considered gifts to that customer.

- If you and your spouse give a gift, you are both treated as one person for the $25 test. So, your combined gifts to a single customer cannot exceed $25 to claim the deduction.

Tip: Free samples are not gifts - they are considered promotional items.

Top of page

Hiring help

Overview

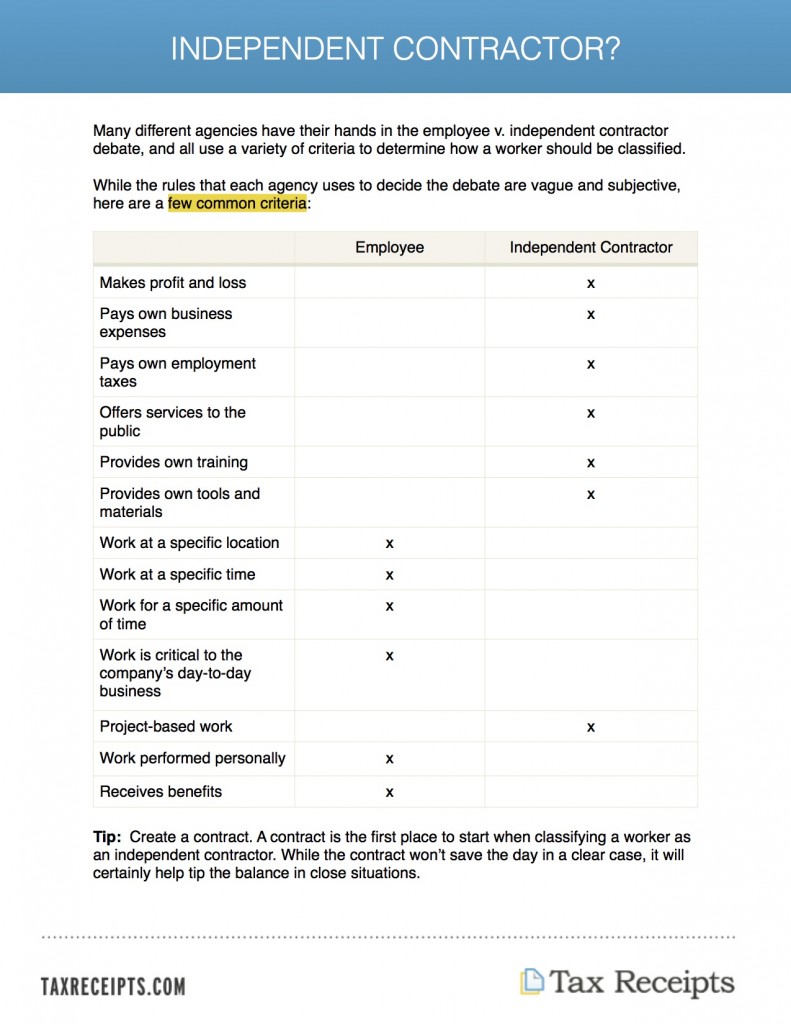

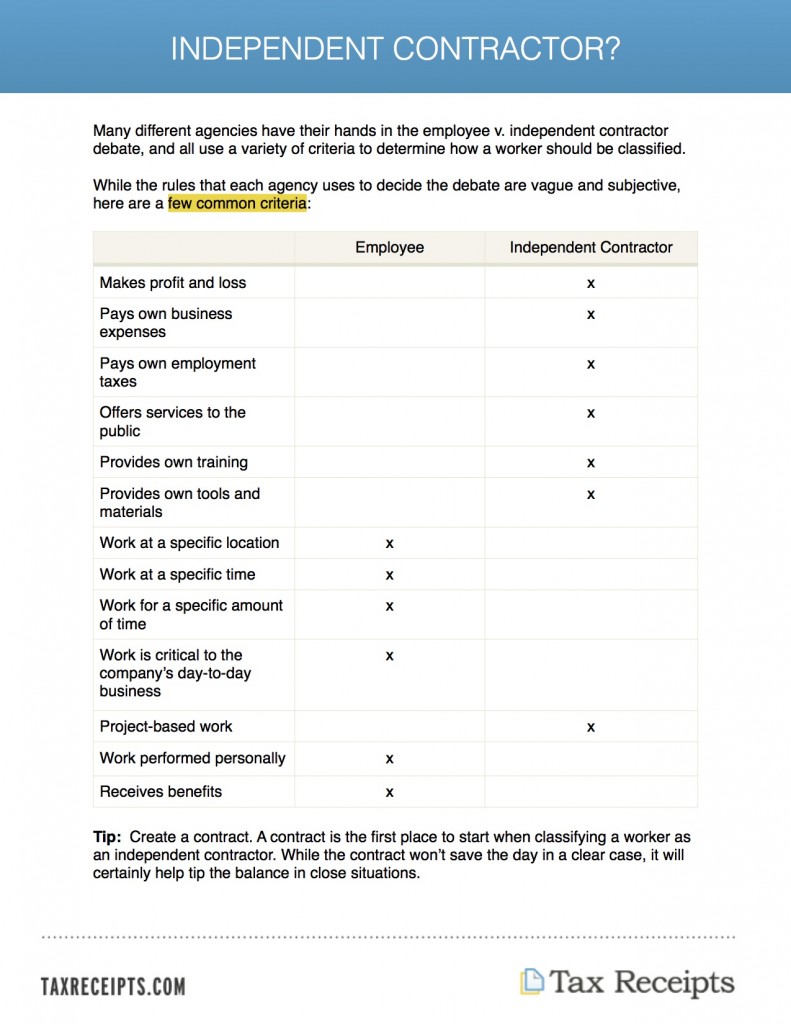

According to the IRS, there are two types of people you can hire to help your business: employees and independent contractors. Make sure to consult a tax professional before hiring help, because the tax and deduction rules are very different for each category.

Employee v. Independent Contractor Diagram

Criteria

- Ordinary and necessary: An expense is ordinary if it's common to your profession. A necessary expense is one that's appropriate or helpful in developing or maintaining your business.

- Current expense: will benefit your business for less than one year

- Directly related to your business: not personal

- Reasonable in amount: reasonableness is dependent on the circumstances and not limited to a specific dollar amount

What is deductible

- Employee wages

- Sales/affiliate commissions

- Subcontractor fees

- Some taxes (see Taxes category)

- Moving expenses paid to an employee if the new job location is at least 50 miles from his or her last location

- Health insurance and other fringe benefits

What to collect

- Name of vendor

- Date

- Amount of expense

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- If compensation is paid in advance, you can only deduct the portion that is paid for the current tax year.

- Compensation paid to an owner-employee should not be unreasonably high considering the services actually performed, or the excessive portion of the salary will be re-characterized as dividends.

Tip: You may be able to hire your spouse as an employee (if he or she actually works in the business) and have the business pay for employment benefits, such as a health care or retirement plan.

Top of page

Home office

Overview

If you use part of your home for business, you may be able to deduct expenses for the business use of your home. This can be a somewhat complicated area, so consult your tax professional or the IRS website if you have any questions.

Criteria

- Regular: use of the home office space on a continuing basis (i.e. not temporary)

- Exclusive: use of the space only for business purposes (i.e. no personal use, even after business hours)

- Used for Business:

- Principal place for work or administrative tasks; or

- Place to meet or deal with clients and customers

What is deductible

- Expenses associated with your home office are deductible

- Mortgage interest, rent, real estate taxes, repairs, utilities, security system, and upkeep expenses

How to calculate the deduction

- Indirect expenses: expenses related to the entire residence

- Ex: Mortgage interest, rent, real estate taxes, utilities, roof repair

- Deduction ratio = square feet of the area used for business / square feet of the entire residence

- Deduction = Expense - Deduction ratio

- Direct expenses: expenses related to the home office only

- Ex: repair of a broken window in the office, cleaning the carpet in the office, purchase of a new door to the office

- Deduction = full value of the expense

What to collect

- Name of vendor

- Date

- Amount

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- You cannot deduct lawn care for the residence.

- Taking the home office deduction may have an impact on the taxes you pay when you sell your home.

Tip: If you work at home and want to take this deduction, use your work space exclusively for work.

Top of page

Insurance

Overview

You can deduct insurance premiums you pay for any business-related insurance policies.

Criteria

- Ordinary and necessary: An expense is ordinary if it's common to your profession. A necessary expense is one that's appropriate or helpful in developing or maintaining your business.

- Current expense: will benefit your business for less than one year

- Directly related to your business: not personal

- Reasonable in amount: reasonableness is dependent on the circumstances and not limited to a specific dollar amount

What is deductible

- Business liability insurance premiums

- Property insurance premiums

- Disability premiums

- Workers' compensation premiums for employees

What to collect

- Name of insurance vendor

- Date

- Cost

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- Car insurance - if you use the standard mileage rate for auto expenses, you do not get a separate deduction for insurance.

Tip: If you qualify for the home office deduction, you may deduct a portion of the premiums you pay for homeowner or renter policies.

Top of page

Licenses and dues

Overview

Expenses to obtain and maintain professional licenses and dues for professional groups or clubs may be deductible.

Criteria

- Ordinary and necessary: common to your profession and helpful or appropriate.

- Current expense: will benefit your business for less than one year

- Directly related to your business: not personal

- Reasonable in amount: reasonableness is dependent on the circumstances and not limited to a specific dollar amount

What is deductible

- Business licenses

- Professional license fees

- Trade association dues

- Franchise fees

What to collect

- Name of vendor

- Date

- Amount

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- No deduction is allowed for social or recreational clubs (country club or athletic club) dues, even if you conduct business there regularly.

Tip: Fees related to your driver's license are not deductible unless your job requires special licensing.

Top of page

Legal and professional fees

Overview

Fees for professional services directly related to your business are deductible expenses.

Criteria

- Ordinary and necessary: An expense is ordinary if it's common to your profession. A necessary expense is one that's appropriate or helpful in developing or maintaining your business.

- Current expense: will benefit your business for less than one year

- Directly related to your business: not personal

- Reasonable in amount: reasonableness is dependent on the circumstances and not limited to a specific dollar amount

What is deductible

- Accountant's fees

- Bookkeeping fees

- Attorney's fees

- Other professional consultants' fees

What to collect

- Name of vendor

- Date

- Amount of expense

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- Professional fees paid for personal purposes are not deductible, even if they relate to your business.

Tip: Ask your accountant to give you an itemized bill showing the cost for preparing your business and personal tax returns, since only the business portion is fully deductible.

Top of page

Meals & entertainment

Overview

You can deduct ordinary and necessary expenses to entertain a client, customer, or employee if the expenses meet the directly-related test or the associated test.

Criteria

- Ordinary and necessary: An expense is ordinary if it's common to your profession. A necessary expense is one that's appropriate or helpful in developing or maintaining your business.

- Directly-related test:

- Entertainment took place in a clear business setting, or

- Main purpose of entertainment was the active conduct of business, and

- You had more than a general expectation of getting income or some specific business benefit

- Associated test:

- Entertainment is associated with your trade or business, and

- Entertainment was directly before or after a substantial business discussion

What is deductible

- Deduction is generally 50%

- Fully deductible

- Recreational gatherings for employees

- Meals furnished on employer's premises for employer's convenience

What to collect

- Name and location of restaurant or event

- Date

- Amount of expense

- Business relationship

- Business purpose

- Enter all of this information into your Expense Tracking System

Gotchas

- Meals and entertainment are highly scrutinized by the IRS.

- You cannot deduct cost of your meal as an entertainment expense if you are claiming the meal as a travel expense.

- Meals and entertainment for only yourself are not deductible unless you are traveling for business.

- You cannot deduct expenses that are lavish or extravagant under the circumstances.

Tip: Remember to always note the names of the people who were in attendance for the meal or entertainment activity on the receipt.

Top of page

Postage and mailing

Overview

Shipping and mailing costs, including the cost of renting a mail box, are deductible business expenses.

Criteria

- Ordinary and necessary: An expense is ordinary if it's common to your profession. A necessary expense is one that's appropriate or helpful in developing or maintaining your business.

- Current expense: will benefit your business for less than one year

- Directly related to your business: not personal

- Reasonable in amount: reasonableness is dependent on the circumstances and not limited to a specific dollar amount

What is deductible

- FedEx, UPS, USPS, other delivery services

- P.O. boxes

- Messenger or courier service

What to collect

- Name of vendor

- Date

- Amount

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Tip: You can deduct the costs of shipping customers' goods if you pay for shipping.

Top of page

Publications

Overview

Reading material that is directly relevant to your business may be considered a business expense.

Criteria

- Ordinary and necessary: common to your profession and helpful or appropriate.

- Current expense: will benefit your business for less than one year.

- Directly related to your business: not personal.

- Reasonable in amount: reasonableness is dependent on the circumstances and not limited to a specific dollar amount.

What is deductible

- The cost of books related to your business

- Cost of subscriptions to magazines, newspapers or newsletters related to your field

What to collect

- Name of vendor

- Date

- Amount

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- Publications purchased for research purposes may or may not be deductible. See the Research category

Tip: Publications that help you avoid legal and professional fees, are fully deductible

Top of page

Rent

Overview

Rent payments for office space and business equipment are deductible as business expenses.

Criteria

- Ordinary and necessary: An expense is ordinary if it's common to your profession. A necessary expense is one that's appropriate or helpful in developing or maintaining your business.

- Current expense: will benefit your business for less than one year

- Directly related to your business: not personal

- Reasonable in amount: reasonableness is dependent on the circumstances and not limited to a specific dollar amount

What is deductible

- Rent payments for property used in the operation of your business

- May be able to deduct lease payments for business equipment

- Any amount paid to terminate a lease early is deductible as rent

What to collect

- Name of vendor

- Date

- Amount

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- If rent is paid in advance, you can deduct only the portion that is paid for the use of the property during the current tax year.

- Rent paid to a related person or entity will be carefully scrutinized by the IRS.

Tip: If you rent space from a relative or a related company, make sure the fair market value of the rental is documented.

Top of page

Repairs and maintenance

Overview

Any upkeep that maintains your equipment in a normal operating condition is deductible as a repair or maintenance. But, if the work adds value or usefulness to the equipment, it may be considered an improvement, and the cost will have to be written off over several years (bad).

Criteria

- Ordinary and necessary: An expense is ordinary if it's common to your profession. A necessary expense is one that's appropriate or helpful in developing or maintaining your business.

- Current expense: will benefit your business for less than one year

- Directly related to your business: not personal

- Reasonable in amount: reasonableness is dependent on the circumstances and not limited to a specific dollar amount

What is deductible

What to collect

- Name of vendor

- Date

- Amount

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- Improvements are not deductible and must be depreciated instead.

- Improvements are any expense that increases the value of your property, makes it more useful, or lengthens its useful life.

- This rule can be difficult to apply, so consult a tax professional if you have questions.

Tip: To properly defend expenses as repairs, maintain good records of the work that was completed.

Top of page

Research

Overview

The IRS definition of research is very narrow, so make sure your expense falls in the "what is deductible" category before claiming the deduction.

Criteria

- Ordinary and necessary: An expense is ordinary if it's common to your profession. A necessary expense is one that's appropriate or helpful in developing or maintaining your business.

- Current expense: will benefit your business for less than one year

- Directly related to your business: not personal

- Reasonable in amount: reasonableness is dependent on the circumstances and not limited to a specific dollar amount

What is deductible

- Reasonable costs incurred to provide information that would eliminate uncertainty about the development or improvement of a product

- A product is defined as a formula, invention, patent, technique, process, model, or similar property

What to collect

- Name of vendor

- Date

- Amount

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- Research does not include customer surveys or the cost of purchasing a process or patent.

- Research deductions are limited to the development of products.

Tip: If you are investigating providing a service, classify any expenses under other categories. Talk with a tax pro before spending money on research. He or she may have some tax-saving advice on how to classify the expense or conduct the activity.

Top of page

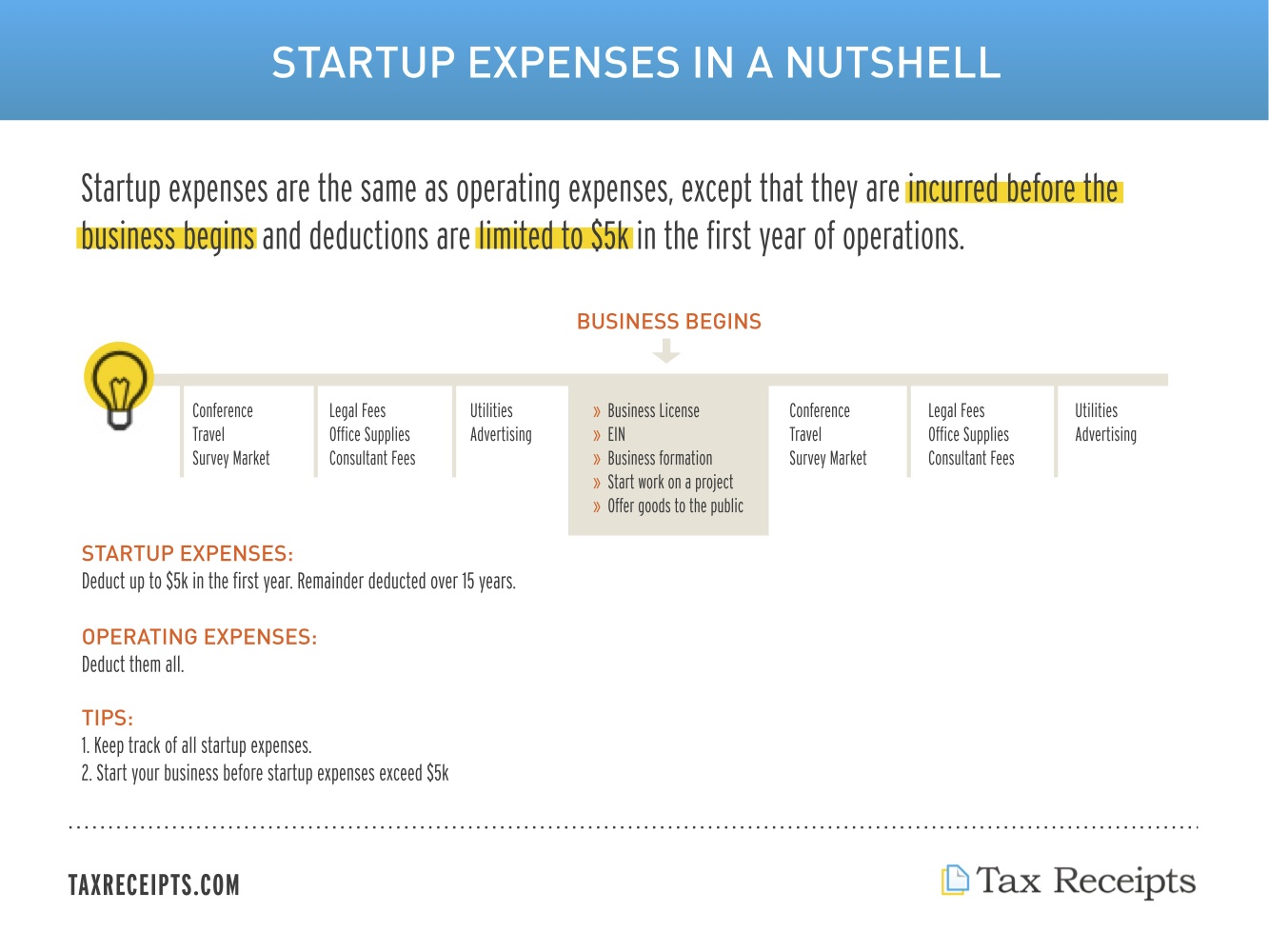

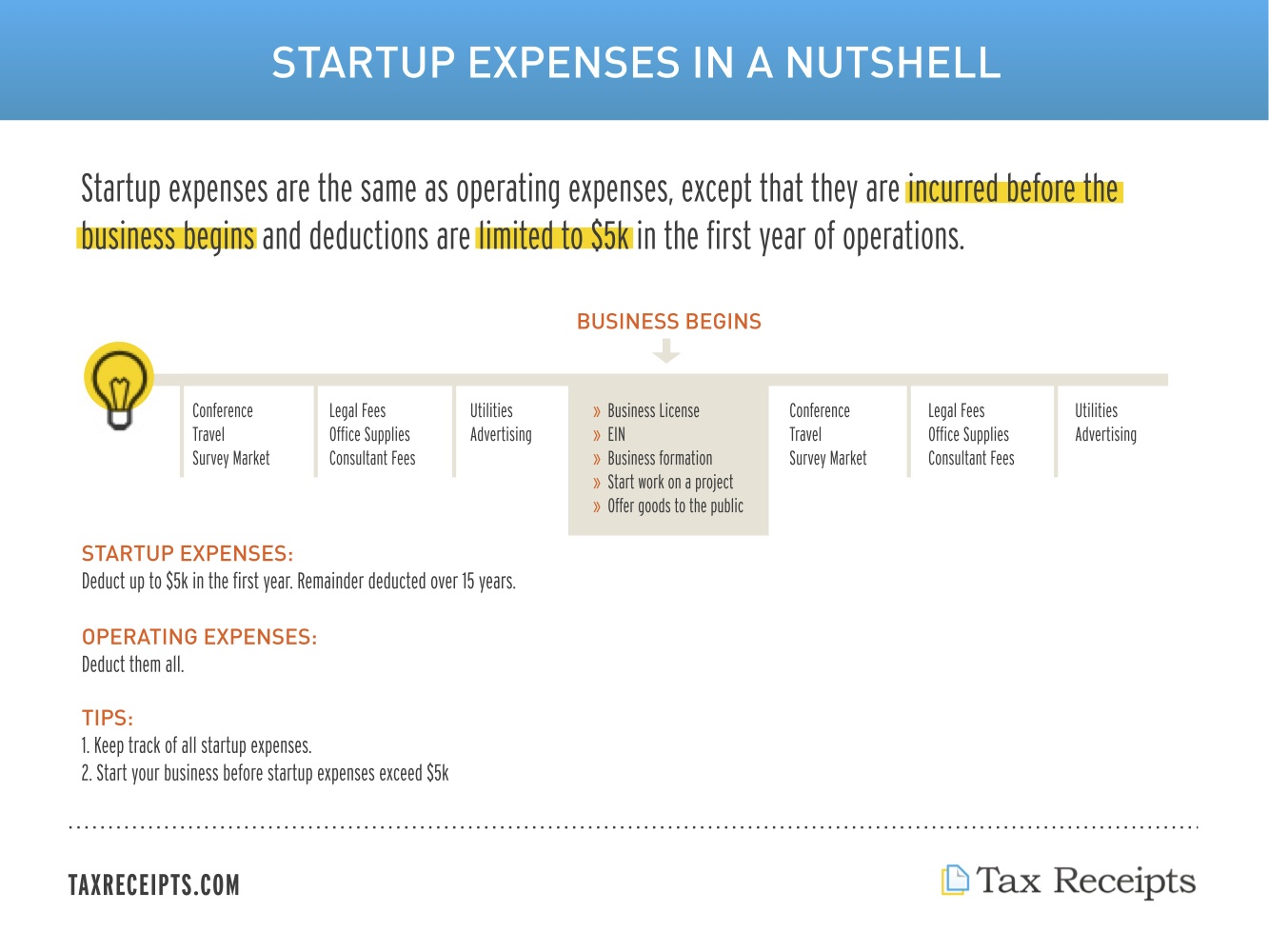

Start-up expenses

Overview

The first $5,000 of the costs of launching your business or acquiring a new business, including forming an entity for the new business can be deducted. Anything over $5,000 must be amortized over 15 years. But, if your total start-up costs exceed $50,000, other rules apply, so contact your tax professional.

Diagram

Criteria

- Current expense: will benefit your business for less than one year

- Paid in connection with creating or acquiring a business

What is deductible

- Expenses incurred to analyze potential markets, products or other aspects of a business

- Pre-launch advertising to promote the business

- Attorney and accounting fees incurred during the formation of the business

What to collect

- Name of vendor

- Date

- Amount

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- If you decide not to start a business after spending money for investigation, the general costs of investigation are not deductible.

- But, if you incur fees to purchase a particular business, and the deal falls through, those investigative costs are deductible.

Tip: "Launch" your business sooner rather than later, and most, if not all, of these expenses will be deductible as ordinary operating expenses and not limited to $5,000.

Top of page

Supplies

Overview

Supplies are those items that are typically used in the provision of services.

Criteria

- Ordinary and necessary: An expense is ordinary if it's common to your profession. A necessary expense is one that's appropriate or helpful in developing or maintaining your business.

- Current expense: will benefit your business for less than one year

- Directly related to your business: not personal

- Reasonable in amount: reasonableness is dependent on the circumstances and not limited to a specific dollar amount

What is deductible

- Material used in the production of services

- Office materials, cleaning supplies

- Coffee, bottled water, food for clients

- Off-the-shelf software

What to collect

- Name of vendor

- Date

- Amount of expense

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- Items with a useful life of over 1 year are equipment, not supplies, and are may not be fully deductible.

- An item may be a supply for one business and inventory for another, depending on whether the item is sold to a customer or used in the performance of services.

Tip: A security system may be deducted as a business supply.

Top of page

Taxes

Overview

Many of the taxes you pay in the course of running your business are deductible. But, this is a very complicated area, so consult your tax professional before taking any of these deductions.

What is deductible

- Employer's share of payroll taxes

- One-half of self-employment taxes (NOT a business deduction - deductible on personal tax return)

- State taxes paid by the company

- Gross receipts or sales tax paid when purchasing goods or services for your business

- Personal property tax on business assets

- Real estate tax on business property

What to collect

- Name of taxing authority

- Date

- Amount of tax

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- No deduction is available for federal income tax incurred or paid.

- Deductions for taxes can be very complicated, so consult your tax professional before taking these deductions.

Tip: Make sure you aren't paying sales tax on items that you will resell. Check your state's requirements for sales tax exemption rules, though.

Top of page

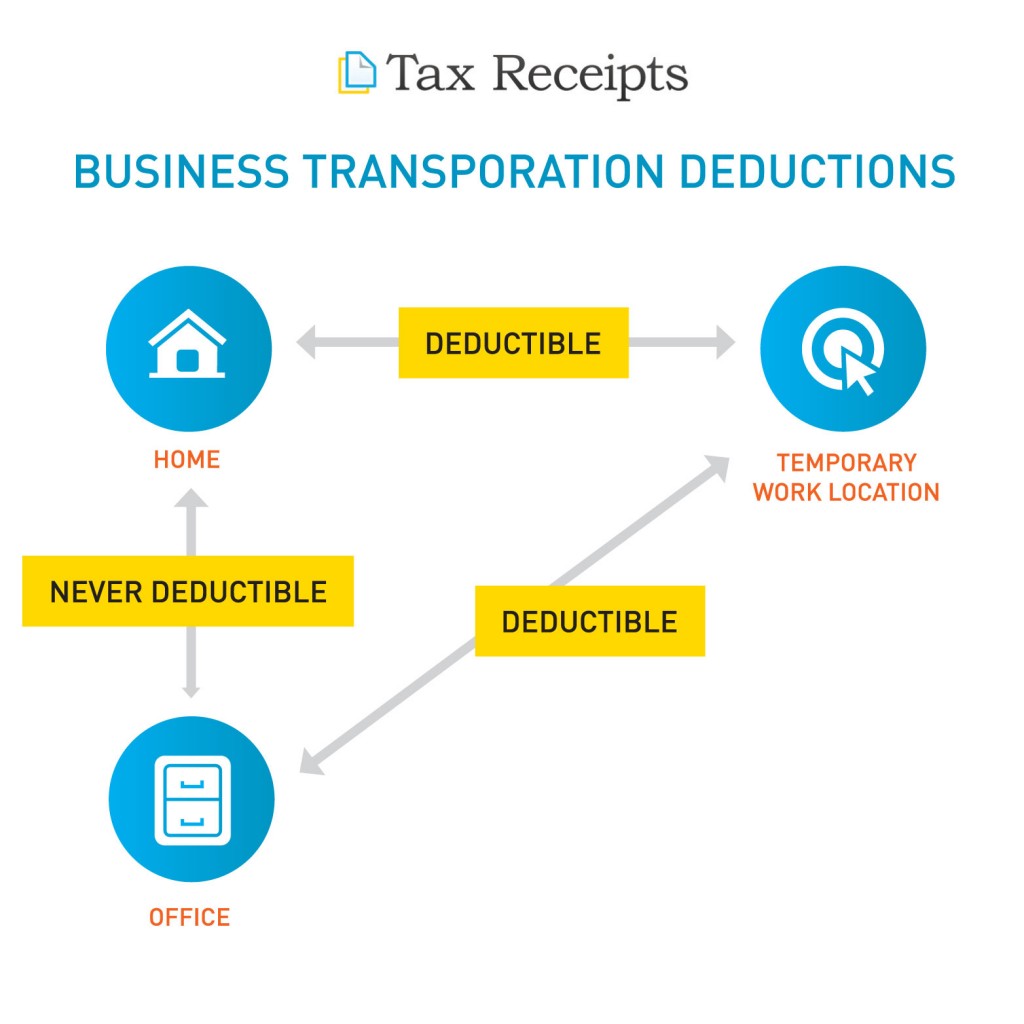

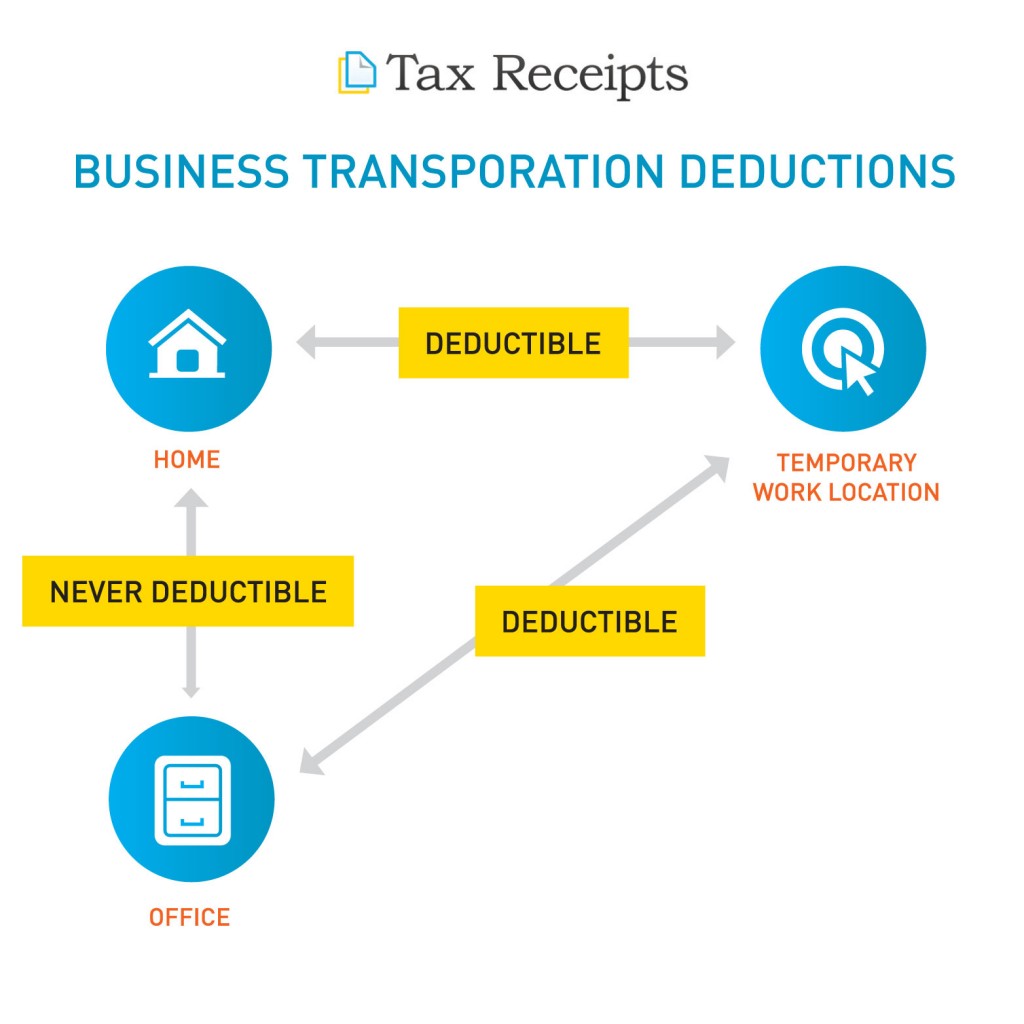

Transportation

Overview

These are expenses you can deduct for business transportation when you are not traveling away from your local area and you are not traveling overnight.

Diagram

Criteria

- Ordinary and necessary: An expense is ordinary if it's common to your profession. A necessary expense is one that's appropriate or helpful in developing or maintaining your business.

- Current expense: will benefit your business for less than one year

- Directly related to your business: not personal

- Reasonable in amount: reasonableness is dependent on the circumstances and not limited to a specific dollar amount

- Travel that is not overnight and that is in your local area

What is deductible

- Vehicle expenses

- 2 methods for calculating expenses

- Standard mileage - Multiply business miles by a per-mile rate set by the IRS.

- Actual expense - Multiply total auto expenses by the percent of business use.

- Tolls

- Parking

- Taxis

- Public transportation costs

What to collect (non-auto expenses)

- Name of vendor

- Date

- Amount of expense

- What you used to pay for the expense

What to collect (auto expenses)

- If using the standard mileage deduction - collect mileage information

- If using the actual expense deduction - collect the same information as non-auto expenses

- Enter all of this information into your Expense Tracking System

Gotchas

- Commuting costs to your normal place of business are not deductible.

- Home office: If your principal place of business is a home office, you can deduct the cost of any trips made to another location for business. The commuting rule does not apply.

- If you have no regular place of business, you can't take this deduction.

- The cost of meals and lodging for local transportation are not deductible

- Transportation expenses are one of the first things the IRS looks at when analyzing a business tax return.

Tip: Establish a "regular place of business" so you can write off any transportation to other work sites.

Top of page

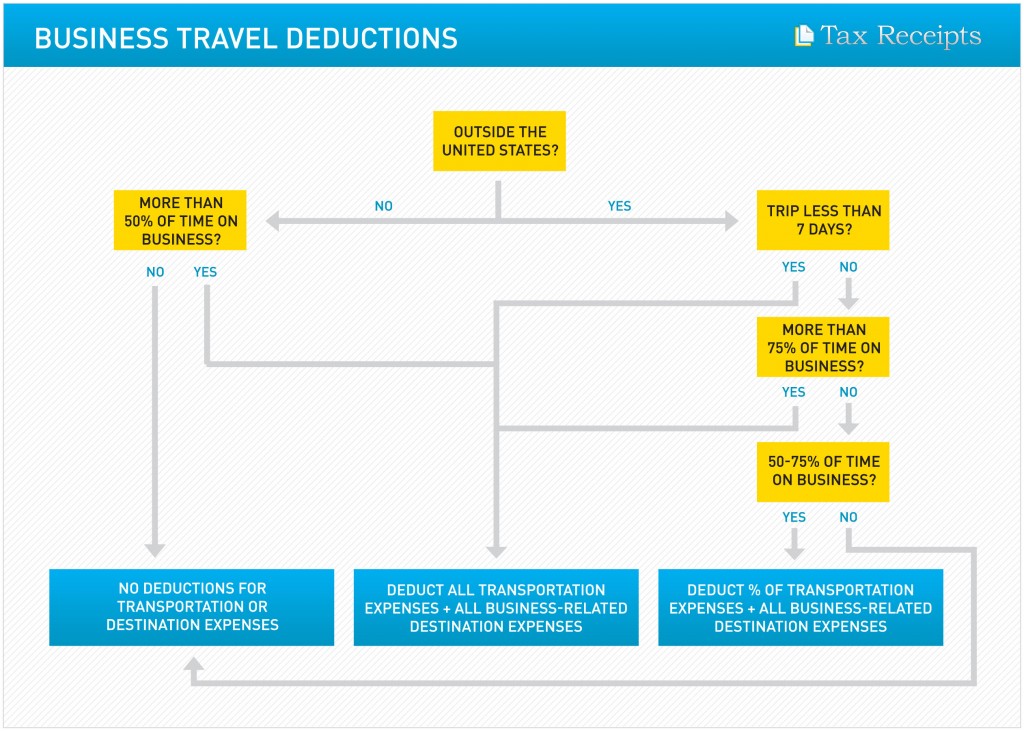

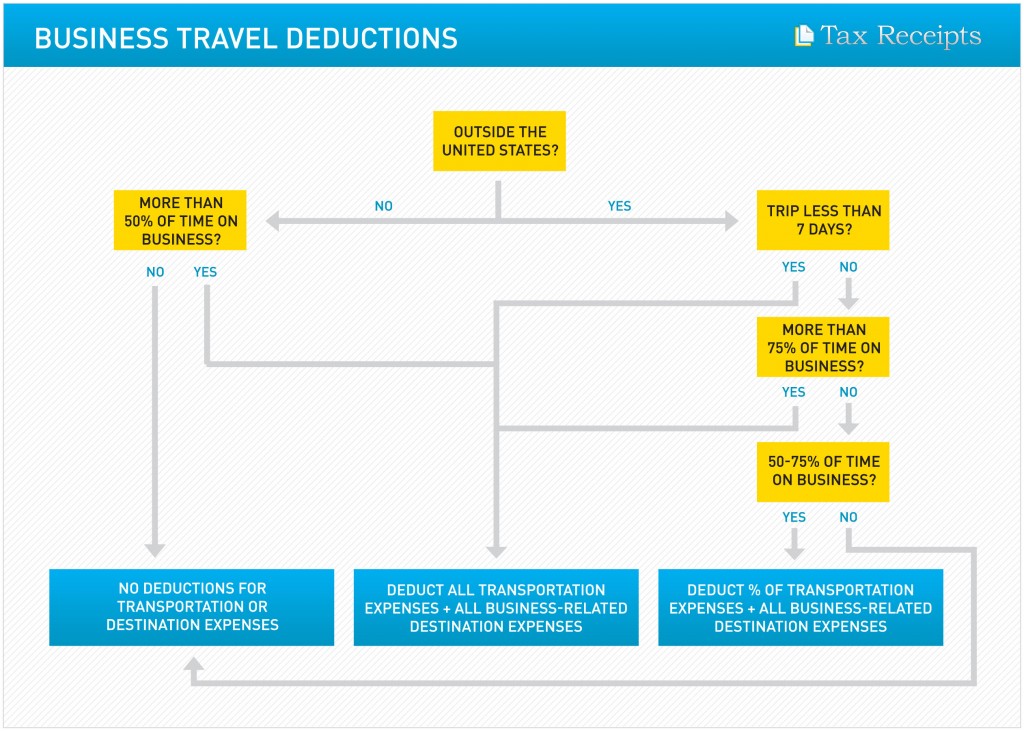

Travel

Overview

Business travel is any travel away from your place of business overnight and for a purpose that benefits your business.

Diagram

Criteria

- Travel away from your "tax home"

- Overnight (or at least long enough to require rest or sleep)

- To conduct a trade or business

What is deductible

- Airfare

- Baggage & shipping

- Automotive expenses

- Actual expense or standard mileage

- Tolls

- Parking

- Rental

- Taxis

- Lodging

- Meals

- Dry cleaning

- Telephone/Internet

- Tips

What to collect

- Name of vendor

- Date

- Amount

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- If you have no "tax home" then you are considered a "transient" by the IRS and cannot deduct travel expenses.

- Travel by cruise ship or other "luxury water vessel" is limited by other rules (but that doesn't mean you can't do it).

- International travel is limited by other rules.

Tip: Establish a "tax home" so you won't be called a "transient" by the IRS and will be able to write off travel expenses. This can be done easily by simply maintaining a consistent mailing address.

Top of page

Utilities

Overview

Utilities paid for an office are fully deductible but may be covered by other rules (Communication, Home Office)

Criteria

- Ordinary and necessary: An expense is ordinary if it's common to your profession. A necessary expense is one that's appropriate or helpful in developing or maintaining your business.

- Current expense: will benefit your business for less than one year

- Directly related to your business: not personal

- Reasonable in amount: reasonableness is dependent on the circumstances and not limited to a specific dollar amount

What is deductible

- Electricity, heat, water, trash pickup

- Security fees

What to collect

- Name of vendor

- Date

- Amount of expense

- What you used to pay for the expense

- Enter all of this information into your Expense Tracking System

Gotchas

- For a home office, the utilities must be pro-rated according to the space taken up by the office. See the Home Office section.

Tip: If you establish a home office, be sure to deduct a percentage of your household utilities.

Top of page

Never deductible

Overview

There are some expenses that are never deductible.

- Government-imposed fines

- Bribes and kickbacks

- Political contributions

- Value of services

- Federal income, gift and estate taxes

- Capital expenses must be depreciated over the item's useful life

- Will benefit your business for more than one year

- Improvements to long-term property

Tip: Even though you can't write off government-imposed fines, you can deduct the costs of fighting the fines if they are directly-related to your business.

Top of page