About Tax Receipts

As a small business owner, how many times have you asked yourself this question:

Is this purchase a deductible business expense?

If you are like most small business owners, you probably ask yourself this question all too often.

We call this the tax guessing game, and unfortunately, this question is costing you money and may be putting your business at risk of being audited.

Streamlined & Easy to Use Tax Information

Let’s face it, most small business owners don’t know the facts about tax deductions and how to track them when they first start their businesses… mostly because getting the facts is time consuming and tedious.

As a new business owner, you are expected to read and understand thousands of pages of tax regulations. If you slip up with your new business and don’t collect the right information to make sure each expense is considered valid by the IRS, then you can be hit with some hefty penalties.

Fortunately, those penalties can be avoided with just a bit of education and a dose of action.

Educated Decisions

With the guidance of our resident tax genius, Kyle Durand, we set out to make TaxReceipts.com the go-to place for easy-to-understand tax deduction information.

To date, Kyle has spent well over 100 hours crafting a definitive guide to business expense deductions and the Travel Expense Pocket Guide.

Originally, we planned to sell this information but ultimately decided to release it for free to help other entrepreneurs breathe a little easier.

If you are new here, jump over to check out the Tax Deduction Guide and the Travel Expense Pocket Guide.

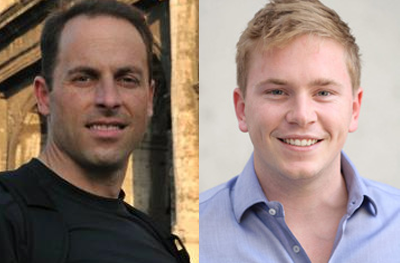

The Tax Receipts Team

Kyle Durand is a tax attorney, tech entrepreneur, former Navy JAG and founder of OurDeal.com. Kyle is passionate about helping businesses run lean and stay agile.

Kyle Durand is a tax attorney, tech entrepreneur, former Navy JAG and founder of OurDeal.com. Kyle is passionate about helping businesses run lean and stay agile.

Nick Reese is a small business owner, business strategist, author, and all-around happy guy who thinks taxes should be much easier to understand.